The FintruX Network is a blockchain-based online ecosystem that connects borrowers, lenders, and ranking service agencies. FintruX facilitates market lending in the correct peer-to-peer network to ease the cash flow problems of small businesses and beginners.

Issues that marginalize traditional financing

Significant Guarantee

Banks like to lend cash in cash. This means they will lend you the same amount of money you have in your savings account, using your money as collateral. This makes it difficult for businesses with low liquidity to get the much needed capital to grow their business.

Strict requirements

Traditional local banks and credit unions offer unsecured loans. However, it is very difficult to get an unsecured business loan through a traditional lender; Especially if your business is young. It takes months to register and few businesses rarely get approval.

Unnecessary Tariffs and Requirements

Less recommended financing options are often available, but these come with outrageous interest rates and unrealistic repayment schedules. Small businesses and beginners should not choose between bankruptcy and loans with unclear, unfair and uncertain terms.

Getting an unsecured loan can be easy, fast, and affordable with a ranking agency's ecosystem, decentralized technology and revolutionary credit enhancement.

Cost reduction is one of the most important motivations in securitization. This is often done through increased credit. We can apply the same principles to reduce the interest rates required by unsecured loans, thus appealing to both the borrower and the lender. Our goal at FintruX Network is to disrupt the way unsecured loans are derived and managed. This paper provides an overview of our approach.

Unsecured loans are loans that are not protected or guaranteed by any assets. In this case the lender takes more risks and is likely to charge a higher interest rate. The more risky the loan, the more expensive it is. We will change it.

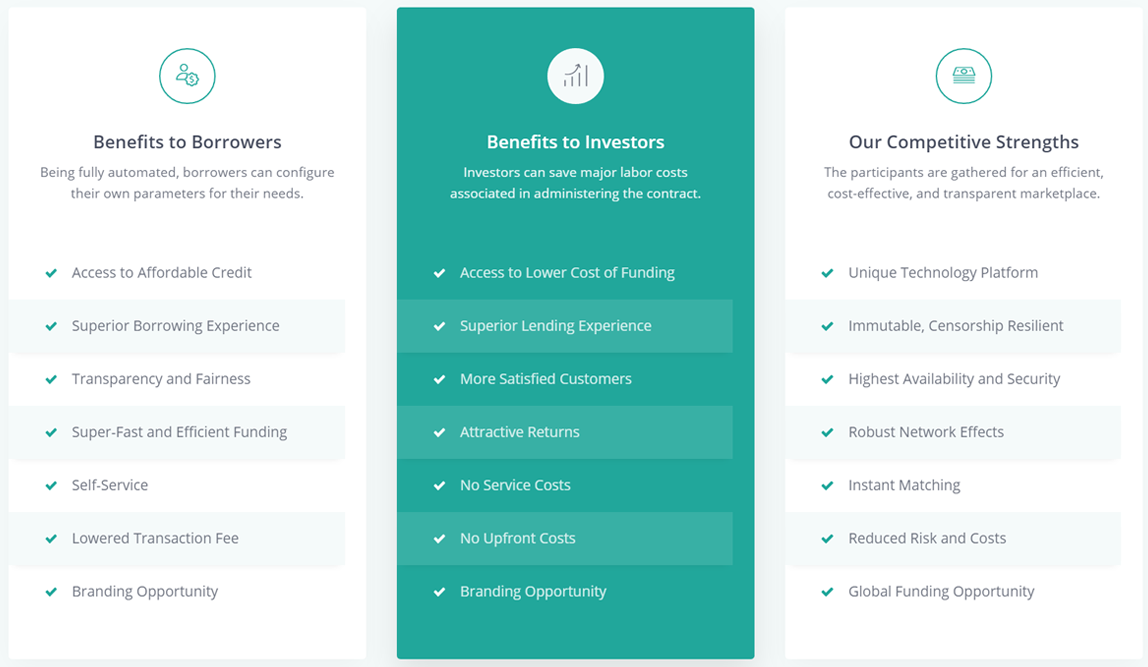

There is an option to get an unsecured loan for your business. Local banks, private lenders, and market lenders such as per-peer and direct platform lenders. However, there is room for improvement in the areas of transparency, risk reduction & interest rates, and the ease and speed of funding. The FintruX network can provide an experience to handle all these things simultaneously.

At FintruX Network we facilitate market lending in the correct peer-to-peer network. Through credit enhancement, we improve creditworthiness. The lender is assured that the borrower will honor the obligation through additional collateral, insurance and third party guarantees. Increased credit reduces the credit / default risk of a debt, thereby improving overall credit ratings and lowering interest rates simultaneously

Four levels of credit enhancement provide an unprecedented risk reduction to unsecured loans:

Over-collateralization acts as an added security; and if it fails to cover all losses arising from the same borrower,

Third party guarantors handle the overflow losses of the above loans; and if still fails, the cross-collateralization pool provides additional insurance; and if still failing, five (5)% of all FTX Tokens have been provided to cover the losses incurred by the creditor.

We solve three major problems for small businesses, especially startups, to reduce their cash flow problems:

By applying credit enhancements, the FintruX Network attempts to neutralize credit risk of lenders and, in the case of defaults, provides cascading rates for insurance to cover losses:

A unique smart contract is created and implemented by the FintruX Network for each individual loan in real time to provide durable, unchanged, and unnecessary arbitration records:

In addition to simplifying the loan application process through instant matching, FintruX Network also provides self-service options to debtors with postpaid financing such as refinancing and prepayment and third-party agency agencies.

STRATEGY

For more information please visit the address below:

Website: https://www.fintrux.com/

Telegram: https://t.me/FintruX

Whitepaper: https://www.fintrux.com/home/doc/whitepaper.pdf

Author: Adikusnadi

Wallet Address: 0x1b1d7A5D27aFA9084E9D38765F20ed9fE96e6050

Tidak ada komentar:

Posting Komentar