Introduction

With the development of technology in our global world, major changes and growth also occur in banking and financial systems. In addition, with the tremendous spread of digital money, many regions of the world are affected by crypto money, from a series of sanattan to education and finance. But the situation is not the same in most parts of the world. The population of developing countries (Southeast Asia, Latin America and Africa) is more than 2 billion. Only Africa lives 1.2 billion people. The use of cellular phones in Africa has increased from 130 million in 2005 to 900 million by 2015. Banks are gradually beginning to make mobile banking. In this framework, to develop online banking services, Al Party, to provide digital benefits to integrate millions of people into the official financial sector and to develop merchant payment services. Banks and Credit Union, the percentage of Africans who can not benefit from prepaid credit cards and financial services, fell from 95% to 60%. However, many problems still exist. Now I will introduce you to the solution of this problem, Ceyron is a revolutionary financial cryptographic company.

Investment Objectives and Strategies Investment objectives

The IMF is to provide an attractive return on invested capital through a proprietary quantitative approach to underwriting credit assets, to be awarded by Colombus Investment Management Ltd. The IMF will adhere to data-driven investment strategies, where machine learning in non-parametric statistical models is fully applied to the expected financial benefits of investment.

The net income earned by the Fund during a particular month will generally be retained for reinvestment, but a portion of potential periodic revenue may be used to distribute annual dividends to holders of CEY Token, whereby the dividends are approved by the shareholders and CFL shareholders.

Credit Portfolio Support Token To Provide Lower Volatility and Cash Flow

The portfolio of credit assets will then be secured by a guarantee to improve stability and return. Fund managers will use artificial intelligence and machine learning to build a secure asset loan portfolio.

Blockchain Technology Enables Efficient Liquidity for Investors

Blockchain technology has the potential to provide greater integrity, security, security, and transparency. Thus, CFLs will use blockchain to ensure immediate deal handling at low cost in the hope of providing greater liquidity to investors.

Efficient Prepaid Debit Card

The account holder will be authorized to choose from multiple cryptoes to use as a tender, and when making transactions (eg dinner at a cost of $ 83.65), prepaid debit debit money will be used, or the holder may choose to use a supported crypto then it will be sold at a spot price to complete the transaction.

Competitive Cost

Since CFLs will hold both cash and a series of crypts at all times, it will be able to facilitate a smooth cash transfer in Crypto to facilitate transactions, and will enable CFLs to compete with Coinbase on services and fees.

CFL Launches to Market Growing Market

for emergency cryptoes has grown over a hundred and sixty billion USD ($ 160 billion) in the past year. Financial giants and the Central Bank have both invested in blockchain technology. Both large and small investors are looking for a more orderly market that allows safety nets and insurance coverage to be offered in the registered security market.

The banking level is low

According to experts, more than 2.5 billion low-income and / or middle-income people are not associated with banks. Traditional agency models easily meet the needs of the poorest but no longer meet the bank's full requirements.

The reason for low banking penetration is at two levels.

At the client level: most people only have low or very low income, and thus save low capacity. While economic monetization has increased significantly since the 2000s, bank use has not been part of spontaneous practice. The emergence and rapid growth of powerful microfinance companies radically changed this situation.

At the bank level: the relative excess liquidity of banks is not an incentive for customer development. Weak population density adds to the average cost of the implementing agency.

A very competitive market

More than 75% of countries have most of the services where mobile money services are available. This increased competition means that consumers have more choices. Some subscribe to two or three services simultaneously.

Very low usage rate

Africa is the world leader in mobile money account 2% of adults have mobile money accounts in the world, 12% holders are in Africa. Every year the number of open mobile money accounts increased by an average of more than 40%. By 2020, the number of Africans with discretionary income - almost 450 million people - will be comparable, if not superior to Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. Generates potentially nearly 10 billion transactions per day worth almost $ 135 billion dollars by 2020.

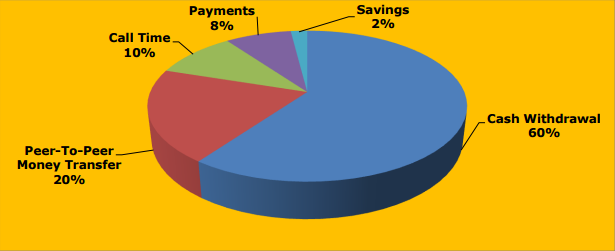

User behavior analysis of means of payment appears to be a general trend: the withdrawal represents at least 60% of the volume of transactions; peer-to-peer diversion operation 20%; buy call time 10%; 8% payment and 2% savings.

CFL Credit Portfolio Fund, Colombus Investment Management Ltd. and the main asset is a loan asset purchased from a non-bank. Assets consist of mortgages, second mortgages, real estate bridge loans, auto loans, equipment and lease lending, commercial mortgage loans, asset-based loans, and factoring contracts. Non-bank financial institutions form credit assets and generally retain all service responsibilities. The IMF will, from time to time, purchase credit assets in pools, on all separate credits or in all participation with credit. In addition to paying a nominal service fee to fulfill the collection function and collection of a typical creative credit asset receiver, the loan will continue to be the primary service provider of the transfer of resources, including the obligation to provide special services if warranties are issued. The loan has been updated and completely replaced. In addition to the service functions provided by the creditor, if one or more creators are unable to perform the task, a secondary "backup" service task is enabled. This ensures that cash collection and repayment of credit assets continue. Today, 60 percent of US mortgage loans are held by banks up to thirty percent (30 percent) by 2013. This is held on the bank credit platform of hundreds of US banks trillions of US dollars alone on US mortgages. The Investment Manager must approve payment of debts and risks associated with the platform itself and should notify the credit profile of the asset, origin, volume, coverage, timing and initial costs for regulatory compliance, quality management and service quality. The Investment Manager will be tasked with selecting the highest performing assets available on this platform for the CFL portfolio, as well as liquidating the highest risk assets of the CFL portfolio.

CEY Token - offers smart digital sign representing lucrative holdings in CEY's non-voting shares to be held by Loyal Agency & Trust Corp, trusted by possession of the CEY Token.

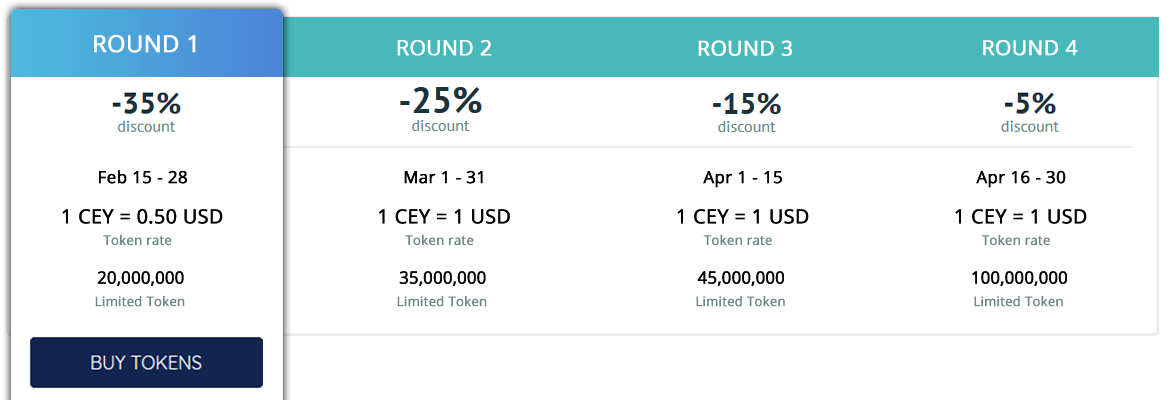

Some information;

Token Name: Ceyron

Icon Token: CEY

Price: 1.00 USD per CEE Token

Number of Tokens Sold: 250,000,000

Pre-ICO Sale Start: 16.2.18

Pre-ICO End: 15.3.18 Discount

Before ICO: 30%, 25% 15%

ICO Start: 3/16/18

Soft Cap: TBA

Hard Cap: TBA

Token Sale End: Hard Cap

Accepted Currency received: BTC, ETH, LTC and USD

For more information, please visit the link below.

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Telegram: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

Facebook: https://www.facebook.com/Ceyron/

Linkedin: https://www.linkedin.com/in/haythem96/

Twitter: https://twitter.com/cryronico

Instegram: https://www.instagram.com/cryronico/

Author: Adikusnadi

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile

ETH wallet address: 0x1b1d7A5D27aFA9084E9D38765F20ed9fE96e6050

Tidak ada komentar:

Posting Komentar